Optimize Your Home Financing Potential with a Mortgage Broker Glendale CA

Optimize Your Home Financing Potential with a Mortgage Broker Glendale CA

Blog Article

The Advantages of Engaging a Home Loan Broker for First-Time Homebuyers Looking For Tailored Funding Solutions and Professional Advice

For novice property buyers, browsing the complexities of the mortgage landscape can be daunting, which is where involving a mortgage broker proves very useful. Brokers use individualized financing services tailored to specific monetary scenarios, while likewise giving experienced advice throughout the whole process.

Comprehending Home Loan Brokers

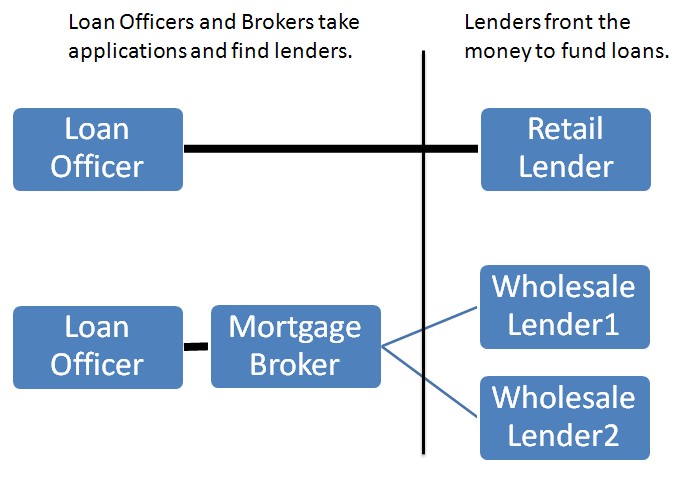

A mortgage broker serves as an intermediary between loan providers and debtors, promoting the financing application process for buyers. They possess experience in the mortgage market and are skilled in numerous lending items offered. This knowledge allows them to assist first-time homebuyers with the frequently complex landscape of mortgage alternatives.

Usually, mortgage brokers function with a range of loan providers, enabling them to present several funding options customized to the specific needs of their customers. Their function includes evaluating a borrower's financial situation, credit reliability, and homeownership goals to match them with appropriate lending institutions. This not just saves time but additionally boosts the possibility of protecting beneficial lending terms.

In addition, mortgage brokers handle the documentation and connect with lending institutions in support of the debtor, enhancing the process and alleviating several of the stress connected with acquiring a home mortgage. They likewise remain upgraded on sector fads and regulative changes, making sure that clients receive exact and prompt advice. By leveraging their partnerships with loan providers, home mortgage brokers can often work out much better prices and terms than individuals may safeguard on their own, making their solutions important for novice homebuyers navigating the mortgage procedure.

Personalized Financing Solutions

Individualized funding solutions are necessary for novice property buyers seeking to navigate the intricacies of the mortgage landscape. Each buyer's monetary scenario is distinct, including varying credit history, income levels, and personal financial objectives. Involving a home mortgage broker permits customers to accessibility customized financing options that align with their details demands, ensuring a more efficient mortgage experience.

Mortgage brokers have access to a vast array of loan providers and home loan items, which enables them to existing customized choices that may not be offered via conventional banks. They can analyze a buyer's financial account and recommend suitable financing programs, such as traditional loans, FHA fundings, or VA car loans, relying on the person's objectives and qualifications.

In addition, brokers can bargain terms with lenders in behalf of the property buyer, potentially safeguarding far better rate of interest and reduced charges. This individualized approach not only enhances the chances of car loan approval but additionally gives comfort, as first-time purchasers frequently feel bewildered by the decision-making procedure.

Inevitably, individualized financing options used by home mortgage brokers encourage new buyers to make educated options, leading the means toward successful homeownership tailored to their monetary conditions. Mortgage Broker Glendale CA.

Specialist Advice Throughout the Refine

Expert support throughout the home mortgage process is vital for newbie homebuyers, that may find the complexities of securing a financing daunting. A mortgage broker functions as a vital resource, using competence that aids navigate the myriad of requirements and alternatives included. From the preliminary consultation to closing, brokers supply quality on each action, guaranteeing that homebuyers recognize their implications and selections.

Home mortgage brokers simplify the application procedure by assisting with paperwork and documentation, which can usually be overwhelming for beginners. They assist recognize potential pitfalls, informing clients on usual blunders to stay clear of, and ensuring that all essential info is properly offered to lending institutions. This positive technique not only simplifies the process yet additionally improves the likelihood of safeguarding favorable lending terms.

Accessibility to Multiple Lenders

Accessibility to numerous loan providers is a substantial advantage for novice homebuyers collaborating with a home loan broker. Unlike typical banks, which might provide a limited array of home mortgage products, a home mortgage broker has access to a varied network of loan providers, consisting of local banks, cooperative credit union, and nationwide organizations. This wide gain access to permits brokers to offer a variety of funding choices customized to the special financial circumstances and preferences of their clients.

By evaluating numerous lending institutions concurrently, property buyers can benefit from affordable rates of interest and differed car loan terms (Mortgage Broker Glendale CA). This not only boosts the possibility of securing a home loan that fits their spending plan however likewise gives the chance to contrast various items, ensuring notified decision-making. Additionally, a mortgage broker can recognize niche lenders that may provide customized programs for new customers, such as reduced deposit alternatives or gives

Moreover, having access to numerous loan providers boosts negotiation power. Brokers can leverage offers and terms from one lender against one more, potentially resulting in far better financing arrangements. This level of access ultimately encourages novice property buyers, giving them with the devices necessary to navigate the complexities visit homepage of the mortgage market confidently.

Time and Price Performance

Dealing with a home mortgage broker not only offers access to numerous lenders but also considerably improves time and cost performance for first-time buyers (Mortgage Broker Glendale CA). Browsing the facility landscape of mortgage alternatives can be discouraging; nevertheless, brokers enhance this process by leveraging their industry knowledge and well-known partnerships with lenders. This permits them to rapidly identify ideal loan items tailored to the purchaser's financial situation and goals

Furthermore, mortgage brokers save clients beneficial time by managing the tiresome paperwork and communication entailed in the mortgage application process. They guarantee that all paperwork is complete and precise before entry, decreasing the likelihood of hold-ups brought on by missing details. This proactive method expedites authorization timelines, making it possible for buyers to secure financing more swiftly than if they were to navigate the procedure separately.

Conclusion

Involving a home mortgage broker supplies newbie property buyers with essential advantages in navigating the complex landscape of home funding. By enhancing the home mortgage procedure and leveraging partnerships with multiple lenders, brokers boost both performance and cost-effectiveness.

For novice property buyers, navigating the complexities of the home mortgage landscape can be challenging, which is where involving a home loan broker confirms vital.In addition, home mortgage brokers handle the documentation and communicate with loan providers on part of the customer, streamlining the process and easing some of the stress and anxiety connected with obtaining a mortgage. By leveraging their partnerships with loan providers, home loan brokers can often bargain far better prices and terms than people could secure on their own, making their services indispensable for first-time homebuyers browsing the home mortgage procedure.

Eventually, engaging a home loan broker makes certain that property buyers obtain tailored support, aiding to debunk the home mortgage procedure and lead them towards effective homeownership.

Unlike traditional financial institutions, which might use a minimal variety of home loan products, a home loan broker has accessibility to a varied network of loan providers, including regional banks, credit history unions, and nationwide institutions.

Report this page